With a stable economy, business-friendly policies, and a strategic location, Dubai has become a hub for international trade and investment. From real estate to tourism, infrastructure to technology, Dubai offers a diverse range of investment opportunities that cater to the needs of investors of all kinds.

Nestled in the bustling heart of Motor City, Dubai, Sobha Orbis redefines sophisticated urban living. Featuring seven premium towers, this development offers elegantly designed 1, 1.5, and 2-bedroom apartments that provide a lifestyle beyond the ordinary.

Crafted for Luxury

Sobha Orbis is synonymous with luxury, from its contemporary architectural design to its exquisite interior finishes. Residents can indulge in the resort-style pool, relax in beautifully landscaped gardens, or stay fit in the state-of-the-art fitness center. Located just minutes from Mohammed bin Zayed Road and Al Qudra Road, Sobha Orbis ensures easy access to key destinations.

Launch Event in Hong Kong | September 14-15, 2024

The roadshow in Hong Kong on September 14-15, 2024, organized by Knightsbridge Partners along with three leading agency partners, attracted nearly 500 clients. Themed “Amplify Your Wealth and Elevate Your Living in Dubai,” the event showcased investment opportunities in Dubai’s vibrant real estate market, with entry points starting from HKD 2.1M.

Sobha Realty, a name synonymous with luxury, highlighted its commitment to superior craftsmanship and innovative design through projects like Sobha Orbis. Attendees explored the benefits of the Golden Visa through property investment and gained insights into UAE mortgage processes, taxation, business setup, and Emirates ID applications. Exclusive guidebooks were provided to the first 100 participants, and private consultations offered personalized investment strategies.

Knightsbridge Partners, a global leader in real estate, emphasized the advantages of Dubai’s property market, playing a pivotal role in connecting international investors with prime opportunities. Their extensive Global Agency Network successfully converted many attendees into buyers during the event.

Gardenia Bay offers a harmonious blend of nature and urban tranquility, bringing modern waterfront residences to the vibrant heart of Yas Island. Developed by Aldar Properties, this new residential community features 210 luxurious studios, one-bedroom, two-bedroom, and three-bedroom apartments in its first phase, available to buyers of all nationalities starting 08 September 2023.

Spanning an impressive 260,000 sqm, Gardenia Bay includes residential units, an urban beach, communal spaces, wellness facilities, retail areas, and a mosque. Situated adjacent to Yas Park and within cycling distance of popular attractions like Yas Mall, Ferrari World Abu Dhabi, and SeaWorld Abu Dhabi, the location offers unparalleled convenience and connectivity.

Announced on 30 August 2023, Gardenia Bay aims to seamlessly integrate nature with urban living. The master plan focuses on walkability and well-being, featuring nearly 1 kilometer of canal frontage to promote a healthy lifestyle.

Strategically positioned, the development benefits from proximity to key attractions and easy access to Abu Dhabi International Airport and major highways to Saadiyat Island, downtown Abu Dhabi, and Dubai.

With starting prices of AED 805,000 for studios and AED 3.1 million for three-bedroom apartments, the first phase of Gardenia Bay includes 210 out of the total 2,434 homes. Buildings are oriented to maximize shade and minimize heat, with significant emphasis on landscaping and water features for cooling. Residents will have direct access to Yas Island’s 10 km canal front promenade, designed to minimize vehicle access.

Gardenia Bay offers a host of community amenities, including ‘The Bay View’ social clubhouse, co-working spaces, outdoor working pods, community farming, zen gardens, barbecue areas, educational kids’ play areas, an amphitheater, and an urban beach club. Additional amenities include a gymnasium, cycling and jogging tracks, a café, a multi-purpose area, and a mosque with a capacity for over 2,000 worshippers.

Rashed Al Omaira, Chief Commercial Officer at Aldar Development, expressed enthusiasm about Gardenia Bay, highlighting its focus on wellness, nature, and premier waterside living on Yas Island. He emphasized the varied amenities and community spirit that will attract both existing and new customers.

Gardenia Bay’s design emphasizes environmental sustainability and community well-being. The development employs modular construction for efficiency and high quality, utilizing recycled materials to balance environmental responsibility with innovative design. Buildings aim for a Pearl 3 Estidama rating and feature monitoring meters to reduce energy, water, and waste consumption. The open spaces are designed with smart irrigation and composting systems, gardens with edible produce, and native and adaptive plant species to promote sustainable biodiversity and pollination.

Construction of the first phase is set to begin in Q1 2024, with handovers expected in Q2 2027.

Disclaimer: The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. ^Travel times are an approximation only, sourced from Transport for London. *Rental yield is projected by the agency and not guaranteed by the developer.

Reasons why you should not missed the Dubai market:

Geographical location

Dubai is strategically located as a gateway to Europe, Africa, and the Asia-Pacific region; making it just a short flight away from numerous countries. It is the gateway between the west and east. Dubai International Airport offers frequent flights to all major worldwide destinations, making the occasional visit home or somewhere exotic quick and hassle-free.

Stable economy

Dubai has a stable and diverse economy that is less dependent on oil than other countries in the region. The city’s government has diversified its investments into sectors like real estate, tourism, and finance, there are many job opportunities available, in a variety of industries. Dubai’s strategic location makes it an ideal hub for trade and commerce between Asia, Europe, and Africa . It is a major financial hub in the Middle East Area.

Tax-free market

Dubai is a tax-free market, there are no corporate tax, personal income tax and withholding taxes, VAT and no capital gains tax. This creates an appealing location for entrepreneurs and investors. According to the UAE Federal Law No.19 of 2018 on Foreign Direct Investment, it effectively outlines foreign ownership and under which sectors it is permitted. With zero limitations on the repatriation of profits, Dubai has a strong track record for securing foreign direct investment.

High return on investment

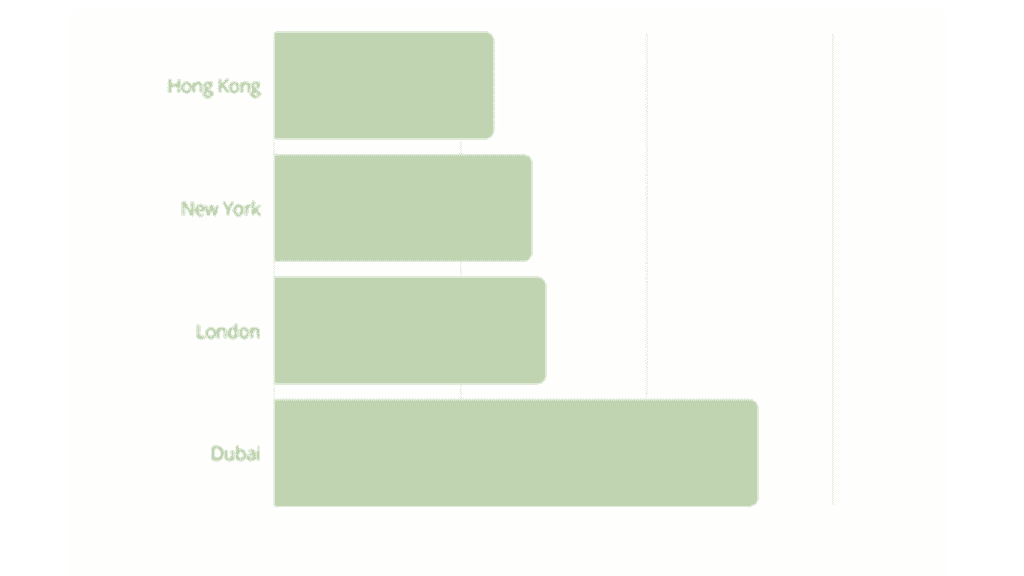

With an average yield of 9.19%, Dubai scored higher than locations such as London (7.89%) and New York (4.48%)! The city is experiencing a surge in new construction projects, which has increased demand for property and resulted in significant capital gains.

Rental Yields in Major Cities

Areas with High Rental Yields in Dubai:

Downtown Dubai

Downtown Dubai remains a buyer’s favorite, serving as one of the world’s most visited tourist destinations. Known for its luxury high-rise towers and upscale community, it’s performing solidly in both the ready and share transfer. With more high-net-worth individuals and international executives looking to settle in Downtown, demand will continue to outstrip supply and properties will be priced at a premium in the near future. With an annualized returns for Downtown Dubai properties, it have delivered a staggering 7.90% return to our investors.

Click Here: Palm Jebel Ali

Dubai Marina

Located in the “new Dubai”, between Jebel Ali Harbour and the American University, the Dubai Marina district is another luxurious icon in the capital of the emirate of Dubai. There’s easy access to the metro and tram stations which link to Downtown Dubai, Business Bay, and JBR making it the best-connected development in Dubai. This convenience and accessibility allows people likely to settle here longer, making it an attractive long-term investment option. Along with stunning waterfront views, proximity to business hubs, as well as attractions like the nearby Walk at JBR, Bluewaters Island, it is said to be one of the most picturesque in the world.

In Q1 2022, real estate activity in Dubai Marina has been maintaining this healthy resurgence. Prices and the number of transactions remain on the rise, with prices almost touching pre-pandemic levels. Overall, Dubai Marina generates and will continue to generate, with an annualized returns averaging at 8.75%.

Jumeirah Lake Towers (JLT)

Situated right behind the Dubai Marina, JLT is a densely populated, mixed-use community of residential and commercial towers, constructed in clusters around four artificial lakes. Close to Dubai Marina, Downtown Dubai, and other commercial hubs, JLT has benefited from an influx of buyers and investors in demand for mid-range properties. What’s more, JLT has similar amenities to its neighbor, Dubai Marina, just at a lower price tag – making it incredibly attractive to investors with a particular budget. With annualized returns of 9.19%, compared to a market average of 5.9%, investing in JLT is a no-brainer!

Dubai Silicon Oasis (DSO)

Recognized as one of the more affordable communities, Dubai Silicon Oasis, is a centrally-located suburb, consisting of an integrated living and working community. As of one of the five major urban centers of Dubai’s Vision Plan 2040 , it is set to be one of the centerpieces of Dubai’s long-term development. Buzzing with innovation, it has become the major hub and incubator for tech startups. Its connectivity to major commercial hotspots.

Click Here: The Sanctuary

Disclaimer:The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. *Rental yield is projected by the agency and not guaranteed by the developer.

Not yet deciding where to stay or settle for your next destinations, Click here to know more about our properties worldwide.

Holland Village, Singapore

With its central location, Holland Village is in close proximity to the downtown and Orchard areas, as well as the open space of the Singapore Botanic Gardens and MacRitchie Reservoir. Though home to lots of families, Holland Village still has a very eclectic feel with a variety of bars, shops local and Western restaurants.

Whether running your own business or looking for a job with an existing business, Singapore has a business environment that is sure to work in your favor. Singapore’s population of only 5 million leaves them hungry to acquire foreign talent, which translates to high acceptance rates on work permits, and high average salary. HSBC’s Expat Explorer Survey reported that the average salary of Singaporean expats is $139,000, compared to the global average of $97,000 for expats living in other countries.

But from recent data of the Singapore’s Urban Redevelopment Authority’s rental index, prices of all private residential properties surged by 29.7% year-on-year in 2022 — the highest since 2007. Foreign residents in Singapore continue to feel the pinch as home rental prices soar and show few signs of returning to pre-pandemic levels soon.

Holland Village is favored for its central location, it is situated near the Orchard and downtown areas.

Bangkok, Thailand

Thailand’s capital city of Bangkok is also one of Asia’s largest cities, making it one of the most popular destinations for expats and digital nomads alike. Living in Bangkok allows you to enjoy a comfortable lifestyle at an incredibly low cost. Everything is cheaper in Bangkok: housing, food, clothing, utilities, childcare, transportation, etc. Rent is 77 percent lower here than in New York, 75 percent lower than San Francisco, 68 percent lower than Seattle, and 50 percent lower than Houston.

As one of the best party cities in the world, Bangkok’s exciting nightlife scene is especially appealing to those who enjoy letting their hair down after work. From bars and karaoke venues to world-class nightclubs and bars, Bangkok has it all.

Consider to live nearby Bangkok City Centre?

Click here for a potential high yield project.

Bangkok is a modern city with ancient roots. With diverse Cityscape, its past is never far from view.

Chiang Mai, Thailand

One of the endearing features is the “Old City” with surrounding moat and city wall remnants encapsulating historic temples, museums, quaint shops, traditional Thai houses. Chiang Mai’s good for solo travelers, couples, or group travelers. You will feel safe and welcomed here by the local people and other expats. there are many expats in Thailand – including digital nomads and teachers. With its budget to luxe hotels, ‘cheap eats’ to upmarket restaurants and bars, it is a remarkable area to explore. Some expats prefer to live along trendy Nimmanhemin Road, with its upscale condos and eateries, designer boutiques, and popular bars. Chiang Mai is one of the best retirement cities in the world but also an exceptional digital nomad hub.

Value for money is another highlight of expat living in Chiang Mai, making it easier for your money to go further, Eating out is inexpensive, as is fresh produce at the local markets. What’s more, medical care is top-notch, and it is a safe environment to live in as well. Chiang Mai has so much to explore for expats, with different types of adventurous activities, famous night markets, temples, and attractions both in and outside of the city.

Rickshaw parked by the inner city moat in Chiang Mai Thailand

Ho Chi Minh City, Vietnam

If exceptionally affordable cost of living and high-speed internet are your main priorities, Ho Chi Minh City could be the place for expats. Expats moving to Ho Chi Minh City will find themselves in a vibrant, engaging culture. According to research, approximately 34% of French expats would be tempted to leave their country within the next 10 years. Their motives are diverse and, numerous, but also personal. The city has everything that an expat or digital nomad needs and is a great place to mingle with like-minded creatives and business professionals.

Ho Chi Minh City has many attractions that you can enjoy whenever you take a break from your computer screen, especially if you’re into history and culture. It offers a unique blend of historic buildings and modern skyscrapers, along with nightclubs, entertainment venues, and shopping malls.

Where to live in HCMC?

Click here to discover the Condo with the Saigon River panoramic view

Expatriates who settle to live and work in HCMC, would definitely love the Saigon Views.

Whether you’re thinking about relocating or becoming location dependent to enjoy living in different locations across the globe, the aforementioned options are all suitable since they will give you plenty to do during your work and leisure time. Want to have more ideas on the accommodations or apartments to live in during your wonderful time in these cities? Contact us for more or click here to check out our latest property listing. Contact us for more!

The UAE has been making waves in the global real estate market for several years now, and its growth trajectory shows no signs of slowing down. When it comes to real estate market of the major areas, both Dubai and Abu Dhabi have their own unique strengths and weaknesses.

Dubai is known for its luxury properties and vibrant lifestyle, while Abu Dhabi offers more affordable options for buyers. According to the statistics, Dubai’s real estate market has seen a higher growth in recent years compared to Abu Dhabi’s. However, Abu Dhabi’s real estate market is expected to grow at a faster pace in the coming years, with the government investing heavily in infrastructure and real estate projects.

Abu Dhabi records 7,474 property transactions over Dhs22.5 billion of real estate during the first half of 2022.

Here are some factors that help you make an wiser decision in investing between Dubai and Abu Dhabi?

Population

Dubai has a population of around 3.4 million, that is almost double the population of Abu Dhabi despite being much smaller in terms of size which makes it much more busier, Abu Dhabi occupies nearly 84% of the country’s total area and has a population of only 1.5M people which is why it may seem slightly more quiet if you are an outgoing person.

Tourism

Tourism in Dubai has been rapidly rebounding since the COVID-19 pandemic. Dubai has officially surpassing its pre-pandemic tourism numbers for the first half of 2023. The emirate welcomed 8.55 million in the first half of 2023 compared to 8.36 million in the same period in 2019. While the Department of Culture and Tourism has announced Abu Dhabi has a continues sustainable growth to reach 24 million visitors target for 2023, an increase from 18 million in the previous year.

Abu Dhabi also proved itself as a premier destination for global sport by hosting key events such as the renowned Abu Dhabi Grand Prix, NBA, and UFC.

Law & Regulations

It’s important to understand the rules and regulations across both emirates as they may limit or hinder your real estate ownership ambitions. In Dubai title deeds are mandatory in both freehold and non-free hold areas for nationals and foreigners alike. Dubai also offers an investor visa when you buy property as a foreigner which can be beneficial if you want to spend some time in the UAE. Under Law Number 13 of 2019 which is the latest amendment to the legislative authority that governs real estate in Abu Dhabi, there are dedicated investment zones that allow foreigners to own real estate (land) within those zones.

Free Zone

Dubai has over 20 free zones (46% of total) that offer a range of opportunities for businesses and investors. The Dubai Multi Commodities Centre (DMCC), Jebal Ali Free Zone, Dubai Airport Free Zone (DAFZA), and Dubai International Financial Centre (DIFC) are among the most prominent free zones in Dubai, attracting a diverse range of businesses, from commodities trading to financial services and technology. Dubai Internet City (DIC) is another popular free zone that provides a hub for technology companies, offering world-class infrastructure and support for startups and established businesses alike.

The free zones in Abu Dhabi cover various industries, business owners can choose to set up companies in Abu Dhabi Airports Free Zone (ADAFZ), Masdar City Free Zone , Khalifa Industrial Zone Abu Dhabi (KIZAD), Industrial City of Abu Dhabi (ICAD), etc

Infrastructure

Dubai International Airport and Abu Dhabi International Airport are two of the busiest airports in the region, offering convenient air travel options for residents and visitors. Dubai International Airport is one of the largest airports in the world, serving over 64 million customers annually and offering flights to over 270 destinations with 140 different airlines. This airport is a major hub for international travel and commerce, providing residents with easy access to destinations all over the world.

Abu Dhabi International Airport is also a major airport, serving around 20 million customers each year. With flights to over 120 destinations with 30 different airlines, Abu Dhabi International Airport provides residents with access to a range of international destinations. Both Dubai and Abu Dhabi airports are well-equipped with modern amenities and facilities, making travel convenient and enjoyable for all passengers. Whether you’re traveling for business or leisure, these airports provide residents with easy access to destinations both near and far.

The award-winning Abu Dhabi International Airport sees more than 50 airlines flying to and from some 102 destinations in over 56 countries.

Disclaimer:The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. *Rental yield is projected by the agency and not guaranteed by the developer. Want to live among sandy beaches, pristine lagoons, and green parks in Abu Dhabi? Garenia Bay by Alder Properties

Phuket is Thailand’s largest island and is one of the world’s most attractive destinations. There are over 1,800 hotels and resorts in the entire province. Its pristine beaches are home to some 400,000 residents, but they welcome over 14 million holiday visitors by the end of 2022.

Reasons why Phuket should be at the top of your list:

Affordability of property prices

Property prices in Phuket are one of the main reasons people want to invest. The average prices of condominiums ranged from 80,000 to 130,000 THB per square meter or 2,500 to 4,100 USD. In stark contrast, the cheapest one-bedroom apartment in Singapore will cost at least 12,000 USD per square meter. Thailand also does not impose taxes on foreign buyers, making it an enticing destination for international investors.

Big Infrastructure Project

The infrastructure of Phuket has transformed dramatically over the past 15 years. A light railway transit connecting the international airport to the resort areas promises to cut travel time and decrease congestion on the highways. Phuket has also established various commercial centers, health facilities, and international schools that cater to the increasing number of visitors and the growing number of people who call the island home.

Accessibility to urban centers

Phuket is only a one hour flight away from Bangkok, an international hub for travelers from Europe and the Middle East. Many Asian countries already offer direct flights to Phuket’s bustling international airport, making the island an incredibly attractive choice for a quick getaway.

Rising demand for rental properties

Tourism has not only benefited hotel properties but other types of short-term housing rentals as well. High-end condominiums and villas are attractive because of their high return on investments, with some developments achieving a 6-7% annual yield. According to a report from the Bangkok Post, the supply of new condominiums grew as much as 30% from the previous year in response to increasing demand from foreign investors from China, Singapore, and Hong Kong.

Even with plenty of supply, many investors are showing confidence in the future potential of Phuket. According to Colliers International, of the over 16,000 new condo units launched that year, more than 70% were already sold.

All these reasons are driving the demand for investment-worthy housing developments on the island. Buying property in Phuket can be a lucrative way to grow your wealth with long-term gains on passive rental income. The relatively affordable prices and strategic development around the island make Phuket not only an attractive place to invest but potentially a great place to call home.

Pool-access units in Central Phuket

From HKD 490,000 – The Origin Kathu-Patong

Before investing in Thailand real estate, you must first understand the general procedures for buying real estate in Thailand. Although most of the procedures for buying property in Thailand are similar to those in Hong Kong, it should be noted that there is generally no brokerage commission for buying a property. Also, the cost will be borne by the seller or developer. Therefore, it is best to seek help from a real estate agent if you want to buy a property in Thailand.

Procedure 1: Property Search

Investors can first search for their favorite real estate in Thailand online. Most real estate websites in Thailand will provide trend information on property prices, rents and rental yields. After investors have selected their favorite real estate, they can contact real estate agents for help. If possible, investors are advised to visit Thailand to inspect the environment in person.

Procedure 2: Hiring a Lawyer and Opening a Thai Bank Account

After you have learned about the real estate information, house type and title period from the real estate agent, you can hire a lawyer to handle legal affairs for you. And remember to open a Thai bank account.

Procedure 3: Deposit

Before paying the deposit, the buyer needs to sign the reserved housing unit document and ensure that the important terms such as the unit number, property price, and payment method on the document are clear and consistent. After that, you can pay 5%-10% of the property price as a deposit by transfer or check.

Procedure 4: Paying the down payment

Before paying the down payment, the buyer must sign a sale and purchase contract with the seller and clearly state the date of ownership transfer in the contract.

Procedure 5: Applying for a mortgage

3 to 6 months before the handover, the buyer can choose to apply for a mortgage for the Thai real estate in a Hong Kong bank, but the interest rate and repayment period of different mortgage plans are different. If you want to apply for a mortgage at the Bank of Thailand, you must pay attention to the fact that you can only borrow up to 50% of the property price.Also, the interest rate is relatively high. Therefore, the best way is to apply for a mortgage from a Hong Kong bank, and then transfer the funds to a Thai bank account for buying a property. However, be careful not to convert Hong Kong dollars into Thai baht in advance, otherwise you will not be able to obtain the FET form (the necessary document for the transfer of title).

Procedure 6: Property acceptance

After receiving the notice from the developer, the buyer can go through the formalities of taking over the building within the specified time. When taking over the building, the buyer may have to pay a one-year management fee, a one-time maintenance fund, water and electricity meters, and the deed tax for handing over the building. In addition, the exact delivery date will be notified.

Procedure 7:Handing over the property

On the day of handover, the buyer will receive the key. The bank will also pay the total amount of the loan to the developer and the balance of the property price must also be paid before then.

Disclaimer:The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. *Rental yield is projected by the agency and not guaranteed by the developer.

Pandemic has destroyed the global economic environment for over three years. With the continuous rise in the number of people vaccinated globally, the economic environment is expected to recover very soon. This is a good opportunity for investors to evaluate their portfolios. Real Estate and Stocks both are mainstream investment tools for investors. But there are some investors who are bearish on the property market, saying that it is not a good time to invest in properties while some even think that buying stocks is better. Is it really better to invest in real estate than in stocks? Without further ado, let me explain it to you!

There are some Hong Kong investors who never invest in local properties because the returns of investment are not attractive for them. Most buyers may apply for a mortgage to invest in property, the annual rental yield is calculated based on the full-paid property. Which means the return is probably higher than they predicted. Obviously, some investors ignore the appreciation return.

Is it better to invest in real estate than in stocks?

It cannot be denied that the threshold for buying stocks is relatively low and investors can enter the market with only a few thousand dollars. However, the stock market is easily affected by external factors, such as company prospects, market trends, industry prospects. Besides, the stock market is fluctuating. However, there are stock enthusiasts who say that if you buy a rising stock, the capital will be doubled. Even so, investors need to spend a lot of time and scheming which is not easy to buy stocks to get rich.

Investing in property is relatively stable

Although investing in real estate is not a 100% profitable deal, it still has a lower risk than buying leveraged stocks. Briefly, the real estate market is relatively stable even in the bear market. The overall decline in property prices will only fall by 10% to 30% which is not as leveraged as stocks. The investors will not lose everything. In addition, the property is a real asset and is less affected by inflation. It is not as easy to manipulate the property market as it is in the stock market.

Some people think that buying the property with leverage is a risky move. However, the risk of investing in a property is limited in reality. As long as investors can still pay the loan on time when property prices fall, banks will not liquidate their positions.

Risk of stock market leverage is much higher

Investors with low capital may borrow money to buy stocks in an effort to create more wealth, while borrowing money to buy stocks is called “financing.” Once the stock price plummeted, the investor could not bear it. When the stock falls to a certain level, the brokerage will require investors to re-deposit money, which is called “maintenance margin”. If investors fail to deposit money in time, the stocks they originally held will be forced to sell.

Perhaps you still insist that stock market leverage is more profitable, but stocks generally have only two or three times leverage. Securities banks may provide a higher leverage, around five to six times, but at the same time with high interest. Investing in a property is completely different. Investors can choose to undertake a 90% mortgage and leverage 10 times. Also, investors can pay $200,000 down payment to invest in a property which is valued at $2 million

Comparison of investing in real estate and buying stocks

| Property investment | Buying Stocks | |

| Capital | More | Less |

| Risk | Lower and property will not be liquidated. | Higher and stock will be liquidated. |

| Nature | Stable | Fluctuated |

| Profit | Increased in small proportion | Increased in larger proportion |

| External factors | Less susceptible | Susceptible |

Property prices in Hong Kong are the most expensive in the world. It is not easy to invest property in Hong Kong. However, investing in the stock market is too volatile and time-consuming. What if you still want to invest in property? Investors may turn their attention to overseas areas. The property prices in some areas are not as high as imagined. For example, in Southeast Asia such as Vietnam, Cambodia, Thailand and Malaysia. Their local property prices are about HK$2,000,000 or below, which is much cheaper than Hong Kong property. Since Southeast Asia is mostly a developing country, the appreciation potential of buildings is higher than that of Hong Kong.

Learn more: Overseas Property Projects

What is “Property Leverage”?

Most people apply for a mortgage when they invest in a property. Some people have a bad feeling simply looking at the word “Loan”, that associated with “Debt” immediately. There are actually two different kinds of “Debt”, good and bad. If you just borrow money from the bank to buy items with no appreciation potential, it is called “Bad Debt”. If you are buying items that have the potential for appreciation and can create wealth for you, it is called “Good Debt”. In addition to the rental return yield, investing in property also has an appreciation return. Therefore, borrowing from the bank to invest in property belongs to Good Debt as it can create wealth.

Speaking of Property Leverage, let’s take a property valued at HKD 2 million as an example. The investor will pay 40% of the down payment which cost $800,000. The rental income can be set off against bank contributions, and after three years the property is valued at $2.5 million and the property has appreciated by 25%. If the investor resells the property, based on the original principal of $800,000, the profit is over 62% and the return is quite high.

What if only rental returns were considered? Again, taking a property of HKD 2 million as an example. The owner borrowed 60% of the down payment which cost $1.2 million. Assuming the interest rate is 4%, the payment term is calculated as 20 years and the monthly payment is about $8,700. If the rental income is more than $8,600, excluding miscellaneous expenses, the owner will spend an extra $100 per month. Looking at the cash flow calculation alone, there is no return at all.

That’s why investors are willing to apply property leverage! At the same time, it is explained that investing in property does not only look at the rental return while the appreciation return is also the income of the investor. If investors intend to buy overseas properties, they should invest in areas with high potential for appreciation. If you are not familiar with the overseas property market, you are welcome to contact overseas property agents. They are more closely aligned with local realities and can carefully analyze the return on investment and property appreciation for you.

Taboos for Property Investment

Real estate generally has a good return on investment , as it can generate ongoing passive income, however, you may need to bear the risk too. While pursuing higher returns, investors should make decisions carefully. They have to consider various factors and plan for the worst. Some may invest wrong in properties because they committed the following taboos.

Taboo 1: Lack of research

The Asia Financial Crisis in 1997 caused many investors to lose a huge amount of money in property investment. They are still unconfident in the property market and are worried about repeating the same mistakes. The investment mentality is very important, just like the investors who have lost terribly recently are all chasing the market in 2018. It is utmost important to observe the market reaction, especially when investing in property. You have to get extra attention when everyone foresees a good property market, while when the market atmosphere is calm, it may be a perfect time to enter the market when no one dares to invest in the property.

Taboo 2: Excessive leverage

The most feared thing for property leverage is overestimation on their loan capacity. The worst case is you cannot even pass the stress test after applying for a mortgage, you are then forced to forfeit the down payment given. Never underestimate the stress test, as it is not a must for everyone to apply successfully for a mortgage!

Taboo 3: Without making any comparison

In recent years, it is often said that properties in Hong Kong Island, near the subway or with invincible seaview have higher return on investment. However, developers may have over gauged the future property value to make it more appealing, indeed, when investing in a property, you are suggested to make more comparisons and evaluation on your own.

It is true that investing in property has a relatively stable return. Although the entry fee is higher, the return earned is often higher than expected. Investing in real estate is different from buying stocks. Nonetheless, they can also be leveraged for investment, but it can make investors lose their money in minutes. And even if property prices fall, as long as investors can continue to make contributions, banks will not liquidate their positions. If you plan to invest in a property, don’t just follow the market trend. Generally, not everyone can make a profit in property investment. Whether to invest in properties or buy stocks, there is no 100% guaranteed yield in investment, so investors must do good in risk management.

If you have plans to invest in overseas properties, but you are not familiar with the overseas property market. Ashton Hawks is founded by a group of senior property investment experts which provides professional real estate consulting services to investors who intend to invest in overseas properties. At the same time, Ashton Hawks will formulate a diversified real estate investment portfolio for reference in order to provide customers with the latest property information to help customers seize every opportunity.

Ashton Hawks also conducts regular property investment seminars which allow clients to keep abreast of market overview, real estate trends and legislative changes. Looking for professional investment property advice? Welcome to leave your contact information and let Ashton Hawks answer your questions!

【UK Property Mortgage 2023】The UK, Canada, and Australia are favorite destinations for immigrants from Hong Kong. Since the UK government’s announcement of the “BNO 5+1” visa policy, the number of immigrants to the UK has been steadily increasing. In June 2023, the UK indicated its intent to tighten immigration policies, and the impact on Hong Kong BNO holders remains uncertain. However, for those aiming for long-term residence in the UK, having a home becomes crucial. As a result, many are exploring the option of buying property in the UK or planning for a UK property mortgage. This article will guide you through the process of buying and selling properties in the UK, how to apply for a UK property mortgage, associated costs, and essential precautions.

UK Property Mortgage Application Process

Buying property in the UK has similarities to purchasing property in Hong Kong, but the procedures and regulations differ. Hence, many from Hong Kong hire agents to help with the UK property mortgage application. Yet, some handle everything on their own to save money. Regardless of the type of buyer you are, understanding the UK property mortgage process is essential to avoid unnecessary losses. Generally, UK property mortgages are categorized into first-hand and second-hand, each with distinct processes and timelines.

First-hand UK Property Mortgage

In Hong Kong, whether you’re buying a first-hand or second-hand property, transactions can take place at property agencies. However, in the UK, the first-hand property buying process differs slightly. Buyers usually select their preferred property in a sales gallery and pay an earnest money (not a deposit!) to reserve it. Once the earnest money is paid, the agent issues a Reservation form to the buyer. This form can then be presented to a bank for a UK property mortgage application. Buyers of properties under construction should begin the mortgage application roughly six months before the anticipated move-in date.

Second-hand UK Property Mortgage

The procedure for acquiring second-hand properties is different from that of first-hand ones. Buyers must first obtain a UK property mortgage approval from a bank before officially placing a deposit and signing contracts with the seller. After successful price negotiations, both parties sign a memorandum of sales. Holding this document, the buyer can then formally start the UK property mortgage application. Typically, the entire process, from application to completion, takes about four months. Therefore, ample preparation and planning time is essential to ensure a smooth purchase process.

Regardless of whether one is buying first-hand or second-hand properties in the UK, it’s crucial for buyers to thoroughly understand the UK property mortgage application process and prepare all necessary documents promptly. Moreover, choosing an experienced and reliable mortgage consultant or agent is vital, as they can offer expert advice and help streamline the UK property mortgage application and purchasing procedure.

Where to Obtain a UK Property Mortgage?

To obtain a UK property mortgage, you don’t necessarily need to be in the UK. Local banks like HSBC, Bank of China (as of September 2023, this bank has suspended fixed-rate mortgages), and BEA (Bank of East Asia) all offer UK property mortgages, or can refer you to their UK branches. However, these three banks only provide mortgages for certain UK cities, with a maximum mortgage ratio of 70-80% and a maximum lending period of 30 years. The mortgage terms differ among these banks, so buyers need to compare carefully and choose the UK property mortgage plan that best suits them. Compared to UK banks, applying for a UK property mortgage through local banks might have higher requirements.

Are There Differences in Mortgages for Personal Use and Rental UK Properties?

For properties in the UK meant for personal use versus those for rental, banks may have different mortgage terms and requirements. Generally, the mortgage ratio for rental properties might be lower, and the interest rate may be higher. In Hong Kong, the three major banks have different criteria for the types of properties they provide mortgages for. BEA only accepts “Buy to Let mortgage” (BTL) applications for rental properties in the UK. So, if a buyer intends to use the property for personal residence, they won’t get mortgage approval. In contrast, Bank of China and HSBC offer mortgage applications for both personal residence “Residential mortgage” and rental properties “Buy to Let mortgage”. Hence, before applying for a mortgage, buyers should clarify their needs, whether purchasing for personal residence or rental, and carefully compare the mortgage terms and requirements of different banks.

Overview of UK Property Mortgage Ratio & Duration

The mortgage ratio for UK property applications is slightly higher than in Hong Kong. This is because the HKMA (Hong Kong Monetary Authority) regulations limit local banks to a maximum mortgage ratio of 50-60%, while branches of banks in the UK are more lenient, with most offering up to a 75% mortgage. If you’re considering buying a property in the UK for personal use, you might want to approach the Bank of China for a UK property mortgage, as it offers up to 80%, the highest among the three banks, with a term of up to 30 years.

While the term is stated as 30 years, many UK banks have a mortgage term formula based on the difference between the retirement age and the age of the applicant at the time of the mortgage application. For instance, if the buyer applies for a mortgage at the age of 30 and retires at 60, the maximum mortgage term is 30 years. However, past data indicates that most mortgage applicants opt for a term between 20 to 25 years.

| Bank | Maximum UK Mortgage Ratio | Longest UK Mortgage Term |

| HSBC | 75% | 25 years* |

| Bank of China | Personal: 80%, Rental: 75% | 30 years |

| BEA# | 70% | 25 years^ |

*Whichever is shorter between 30 years and the difference between retirement age and applicant’s age.

^Whichever is shorter between 65 years and the difference between retirement age and applicant’s age.

#Only offers mortgages for rental properties

However, as for which bank is more suitable for your UK property mortgage, it also depends on whether the bank supports local property mortgages. Considering branches, HSBC has the most branches in the UK, while the Bank of China and BEA have fewer branches in the UK.Bank of China UK Branches:

- London

- Birmingham

- Manchester

- Glasgow

BEA UK Branches:

- London

- Birmingham

- Manchester

If you are interested in purchasing a property located outside of these cities, you might need to inquire with your bank before purchasing to see if they offer mortgages for properties in that area.

UK Property Mortgage Application Criteria and Stress Test

What are the criteria for applying for a UK property mortgage? Generally, for Hongkongers applying for a UK property mortgage, up to 70% of the property’s value can be mortgaged, with most mortgage terms being 20 years. Most banks only accept payments in GBP for their UK mortgage plans, which indirectly exposes Hong Kong property owners to exchange rate risks. At the same time, UK banks will conduct a stress test on the buyer at an increased interest rate of 2%, ensuring that monthly payments do not exceed 50% of their income. Different banks have the following annual income requirements for applicants (only basic salary is considered, without accounting for bonuses and double pay):

| Bank | City | Annual Income Requirement | Type |

| HSBC | UK and Scotland | Individual: £50,000 Company: £75,000 | Residential/Rental |

| Bank of China | London, Birmingham, Manchester | N/A | Residential/Rental |

| Bank of East Asia | London, Birmingham, Manchester | £72,000 | Rental |

UK Mortgage Threshold: How is the Stress Test Calculated?

Buyers applying for a UK property mortgage through a local bank must pass a stress test. With the GBP exchange rate considered by the Hong Kong Monetary Authority as a risk for overseas property investment, it becomes harder for buyers applying through local banks to pass this test. As a result, some buyers opt for mortgages from UK local banks, where the purchasing conditions are more lenient than in Hong Kong.

However, UK banks have stricter income requirements for applicants than Hong Kong, as they only consider net income, excluding all bonuses, double pay, and other incomes. Mortgage applications through UK banks mainly depend on the payment-to-income ratio. UK banks may increase mortgage interest rates to offset risks for higher payment-to-income ratios, with the upper limit being around 60-70%. However, surpassing a 60% ratio is challenging. Additionally, during the approval process, UK banks will also consider the applicant’s expenses and debt situation. Buyers can review their spending situation when applying for a mortgage. UK banks, however, will not review credit databases, commonly referred to as TU.

Types of UK Property Mortgages and Major Bank Comparison

UK property mortgages, like in Hong Kong, come in two types: fixed-rate and tracker mortgages. Repayment plans offer interest-only or interest and principal repayments. According to market statistics, one-third of UK property owners opt for interest-only payments to complete their mortgage repayments.

Fixed Rate Mortgage

With a fixed-rate mortgage, buyers can ensure their payments won’t fluctuate with the Bank of England’s interest rate for a certain period, typically two to five years. Banks initially charge an “arrangement fee” and a “booking fee”. At the end of each fixed-rate period, these fees must be paid again. After three years of a fixed-rate mortgage, buyers can choose a new fixed-rate mortgage plan or opt for a tracker mortgage, redefining their future payment mode.

Tracker Mortgage

The interest rate for a tracker mortgage is determined by a reference rate plus the Bank of England’s base rate. When the Bank of England raises interest rates, the base rate will adjust, and the mortgage interest rate will increase accordingly. So, with a tracker mortgage, the interest rate can either increase or decrease based on economic conditions, leading to variable payments.

Interest-only Repayment

Regardless of choosing a fixed-rate or tracker mortgage, buyers can also opt for “interest-only” repayment. This option targets rental properties with an investment component, and the mortgage ratio must be tightened by 5% compared to the original stipulation. Buyers only need to repay the monthly interest, and some owners choose “interest-only” to maintain sufficient cash flow.

Comparison of Major Banks’ UK Property Mortgages: Which One is Right for You?

If you are considering a fixed-rate mortgage, your only option is HSBC, as it is currently the only major bank in Hong Kong offering a “fixed-rate mortgage” option (as of September 2023, Bank of China has suspended this service). HSBC’s fixed-rate mortgage terms are two, five, and ten years, with varying loan-to-value ratios. Choosing different “initial fixed-rate terms” and “fixed interest rates” will impact the “booking fee”. In simple terms, if the “initial fixed rate” is lower, the “booking fee” will be higher and vice versa. The fixed interest rate for residential properties ranges between 5.54% and 6.63%, while for rental properties, it’s between 5.74% and 6.79%.

Regarding the penalty period for fixed-rate mortgages, if there is a partial repayment or redemption during the fixed-rate period, there will be penalties. HSBC allows buyers to repay up to 10% of the remaining loan amount annually without penalties during the fixed-rate period. If this 10% threshold is exceeded, a penalty of 1-5% will be charged. Additionally, an administrative fee will be charged by the bank during redemption. The Bank of China stipulates that a penalty of 1% of the loan amount must be paid for early repayment within the first three years.

As for tracker mortgages, only HSBC among the three banks does not offer a full-term tracker mortgage. The interest rate for the first two years will vary based on the loan-to-value ratio and the booking fee. Though it appears fixed at first glance, these rates will fluctuate according to the Bank of England’s base rate. After two years, the interest rate for residential UK property mortgages is 6.99%, while for rental UK property mortgages, it’s 7.6%. These UK property mortgage rates will also vary with the Bank of England’s base rate.

Moreover, both the Bank of East Asia and the Bank of China offer full-term tracker mortgages. Their rates will adjust based on the loan amount and the loan-to-value ratio. For instance, the Bank of China’s maximum loan amount is £5,000,000, with its residential property’s full-term rate ranging between 3.39% + the Bank of England’s base rate and 3.99% + the Bank of England’s base rate.

Concerning the penalty period for tracker mortgages, the Bank of China mandates that a penalty of 1% of the loan amount must be paid for early repayments within the first three years. HSBC doesn’t offer any advantages for early repayment; any early repayment or redemption will incur a penalty of 1-5%. The Bank of East Asia charges £150 for partial repayments or early redemption, with an additional £100 administrative fee for full early redemptions.

If you are inclined to choose an interest-only plan without repaying the principal, only the Bank of China offers this option. However, note that this plan is only applicable for rental properties intended for investment purposes, and the loan-to-value ratio will be 5% lower than regular plans.

Table comparing the UK property mortgage plans of the three banks:

| Item / Bank | HSBC | Bank of China | Bank of East Asia |

| Offers fixed-rate mortgage | |||

| Booking fee for fixed-rate mortgage | Varying based on “initial fixed-rate term” and fixed interest rate | _ | _ |

| Range of fixed-rate mortgage interest rates | Residential: 5.54%-6.63%; Rental: 5.74%-6.79% | _ | _ |

| Penalty for early repayment of fixed-rate mortgage | Can repay up to 10% of the remaining loan amount annually without penalty; a 1-5% penalty is charged for exceeding this limit | 1% penalty for repayment within the first three years | _ |

| Offers variable rate mortgages for the entire term | |||

| Variable rate mortgage interest range | Primary Residence: 5.84%-5.94%; Rental: 6.19%-6.39% | Primary Residence: 3.39%+base to 3.99%+base; Rental: 4.09%+base to 4.69%+base | Depends on the loan amount |

| Penalty for early repayment of variable rate mortgage | 1-5% penalty for early repayment | 1% penalty for repayment within the first three years | Early redemption or partial repayment: £150; Full early redemption: £100 administration fee |

| Offers interest-only repayment plan |

UK Property Purchase Process

Step One in UK Property Purchase: Property Search

Similar to Hong Kong, the UK also has off-plan property sales. However, in the UK, there are no specific key dates, only estimated completion dates based on the season. Overseas or UK real estate agents often hold exhibitions in Hong Kong to promote UK properties. Some of these properties are off-plan, while others are existing properties. Existing properties are more popular in the market because they are immediately available for occupancy after purchase, thus, they tend to have higher prices.

Due to pandemic restrictions, it might not be possible for Hong Kong residents to visit the UK in person. However, interested investors need not worry. Exhibitions often provide sample units or models for reference. If one is considering purchasing a second-hand UK property, buyers can browse UK property websites to view photos or take virtual reality (VR) tours of the property. Of course, if needed, you can also request agents to conduct real-time virtual property tours to view the actual condition of the property.

Step Two in UK Property Purchase: Sign the “Preliminary Sales Agreement” and Pay a Deposit

If a buyer has chosen their desired UK property, they need to sign a “Preliminary Sales Agreement” with the owner or developer and pay a deposit, typically ranging from £1,000 to £5,000. If purchasing a second-hand UK property, buyers can try to negotiate the price with the seller. Once both parties agree on the price, they can sign a “Sales Memorandum”. Subsequently, the buyer can appoint a solicitor or agent to proceed with the sales formalities. Of course, those planning to purchase a second-hand UK property can also hire a property surveyor to produce a detailed structural and architectural report.

UK Property Purchase Process Step Three: Apply for a UK Property Mortgage

After successfully signing the “Preliminary Sales Agreement” and paying the deposit, you can immediately apply for a UK property mortgage. Depending on the type of property, such as primary residence/rental/new property/second-hand property, the mortgage procedures and costs may differ. For details, refer to the earlier sections of this article.

UK Property Purchase Process Step Four: Sign the Official Sales Contract and Pay the Down Payment/Deposit

Once the buyer has successfully obtained approval for the UK property mortgage, they can make the down payment to the developer. Simultaneously, if it’s a second-hand UK property, the buyer can pay the deposit. The down payment for new UK properties typically ranges between 10% to 30% of the property price, and some buyers may be required to pay before applying for the mortgage. For second-hand UK properties, the deposit is usually around 10% of the property price, payable to the owner upon contract signing. If the buyer defaults, the deposit is non-refundable.

UK Property Purchase Process Step Five: Property Handover

Developers may request owners who have purchased off-plan properties to pay a portion of the property price 6 months after signing the contract. Therefore, buyers should pay attention to the payment schedule specified in the sales contract. Once the project is completed, the solicitor will notify the buyer to inspect the property and inform them of the exact handover date. On the day of the handover, the bank will transfer all mortgage loans to the developer, completing the entire UK property purchase process.

Additional Information: What are the ongoing expenses after purchasing a UK property?

The table below lists the regular expenses for UK property owners. Prices may vary due to local policies. For the latest information, please contact UK property agents!

| Council Tax | Annual council tax payments are typically between £1,500 to £2,000 for a general property. If the property is rented out, the council tax is paid by the tenant. |

| Ground Rent | Property buyers in the UK are required to pay an annual ground rent to the landlord, typically around £400. |

| Income Tax | If the UK property is purchased for rental purposes, the buyer must pay income tax based on the rental income. Non-UK citizens pay income tax at rates ranging from 20% to 45% of their annual income, while UK citizens have a tax-free allowance below £12,500. |

| Property Management Fee | If the UK property is purchased for rental purposes, a management fee is payable to the property management company, typically about 10% of the monthly rental income. |

| Building Insurance | Buyers of new UK properties receive insurance coverage for 10 years; buyers of second-hand UK properties need to purchase insurance, with costs ranging from £100 to £500. |

Key Points to Note When Applying for a UK Property Mortgage

-

- Prepare necessary documents: UK mortgage applicants need to provide evidence of British Citizen or BNO Visa identity, proof of address, three months of bank statements, and proof of down payment funds. It’s important to note that different banks have varying requirements for document validity. For instance, BEA (Bank of East Asia) requires buyers to provide two years of tax bills, six months of salary slips, and statements; HSBC only requires one year of tax bills, but the rest of the requirements are similar to BEA.

| HSBC | BEA (Bank of East Asia) | Bank of China | |

| Tax Bill | 1 Year | 2 Years | Latest |

| Salary Slip | 6 Months | 6 Months | 3 Months |

| Monthly Statement | 6 Months | 6 Months | 3 Months |

- Allocate Time for Opening a GBP Account: As a popular migration destination, many Hongkongers plan to open offshore accounts to move their assets out of Hong Kong. To avoid affecting the mortgage application timeline, it’s advisable to open a GBP account well before applying for the mortgage.

- Be Aware of Additional Charges: If you plan to transfer GBP from Hong Kong to a UK account monthly, besides considering foreign exchange risks, you should also be aware of potential transaction fees. For instance, with HSBC, if you have an Advanced or Premium account in the UK, you can perform global online funds transfers. However, for standard accounts, electronic remittance methods may incur additional fees.

Pitfalls in UK Property Transactions

Pitfall One: Unfinished UK Property Projects

Just like in Hong Kong, the UK also has off-plan properties. However, UK off-plan properties do not have a “key date,” only an estimated completion date specified by year and quarter. This flexibility often results in projects being “left unfinished” as developers delay handovers significantly. UK off-plan property buyers should note that contracts only offer a Long Stop Date for protection, typically 12-18 months after the expected completion date. Developers can hand over the property anytime within this period without any compensation to the buyer. Hence, buyers should be prepared for flexible timelines.

Pitfall Two: Credibility of Agents/Developers

Often, developers use deposits from off-plan buyers as funding for construction projects. Some smaller developers might pre-sell without official government approval. If the developer faces liquidity problems, prospective buyers might bear the risks. Therefore, it’s recommended to choose reputable, large-scale developers.

Moreover, UK property buyers should be aware that estate agents selling UK properties in Hong Kong are not regulated and do not hold any licenses. Hence, buyers should research and verify the background and reputation of the agent before engaging.

Pitfall Three: Return Guarantees

No investment comes with guaranteed returns. UK property buyers shouldn’t be misled by such claims. Even if developers genuinely offer rental guarantees, they might outsource rental services to rental companies. If these companies go bankrupt, the buyer has no recourse. Additionally, many rental agreements might not cover certain taxes payable by the buyer. Hence, if buyers plan to hire rental companies for their UK properties, they should opt for those regulated by the government.

FAQs Related to UK Property Mortgages

1. Under what circumstances can a mortgage be rejected?

Each bank has different approval criteria. Some might not approve mortgages for older properties, properties with a small area, or those with structural issues. Especially renovated old buildings have had mortgage rejections in the past. For instance, BEA (Bank of East Asia) clearly states they won’t approve mortgages for buyers who own more than three UK properties and won’t consider properties with high ground rents or buildings over 18 meters without external wall structures. HSBC, given the impact of the COVID-19 pandemic, has stricter requirements for high-ratio mortgages and currently won’t approve 85% mortgages.

2. Can Hongkongers get up to 90% mortgage for UK properties?

Generally, when Hongkongers apply for a mortgage for UK properties, they can get up to 70% of the property value, with most mortgage terms lasting for 20 years. Most banks’ UK property mortgage plans require payments in GBP, indirectly exposing Hong Kong owners to currency exchange risks.

3. What are Freehold and Leasehold?

Freehold means the property is owned permanently by the owner. The owner can choose whether to sell the land along with the property. Naturally, properties with freehold status are valued higher. Leasehold properties typically have lease terms of either 90 or 120 years, requiring annual ground rent and maintenance fees. When the lease term expires, there’s a risk of the land being reclaimed.

4. What is the Help to Buy Mortgage Scheme?

The “Help to Buy” scheme allows UK citizens and those with legal residency visas to purchase their first home by paying just 5% down payment. The UK government provides a housing loan ranging from 15% to 40%. For the first five years, buyers don’t have to pay interest, while the remaining loan amount can be mortgaged through a bank. This scheme is only applicable for first-time buyers or those changing homes, with a property price cap of £600,000.

Being a global financial center, the UK witnesses a high influx and outflux of professionals from various countries. Additionally, the UK’s “BNO 5+1” immigration visa policy has led many Hongkongers to reconsider immigration, inevitably increasing the demand for housing in the UK. This rise in demand will likely result in property prices steadily increasing. Regardless of whether it’s for personal use or investment, buying UK properties seems to be a good choice.

After this comprehensive guide, you should have a deeper understanding of the process of buying UK properties and the procedures for applying for UK property mortgages. However, the information provided might change based on UK policies and market factors. If you’d like to stay updated with the latest UK property information, please leave your contact details, and we’ll proactively provide you with the latest updates!

Ashton Hawks was founded by a group of seasoned property investment experts. We offer professional real estate consultancy services to investors interested in overseas property investments. We also provide diversified property investment portfolios for reference, ensuring our esteemed clients are always in the loop and can seize every opportunity.

Disclaimer:The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. *Rental yield is projected by the agency and not guaranteed by the developer.