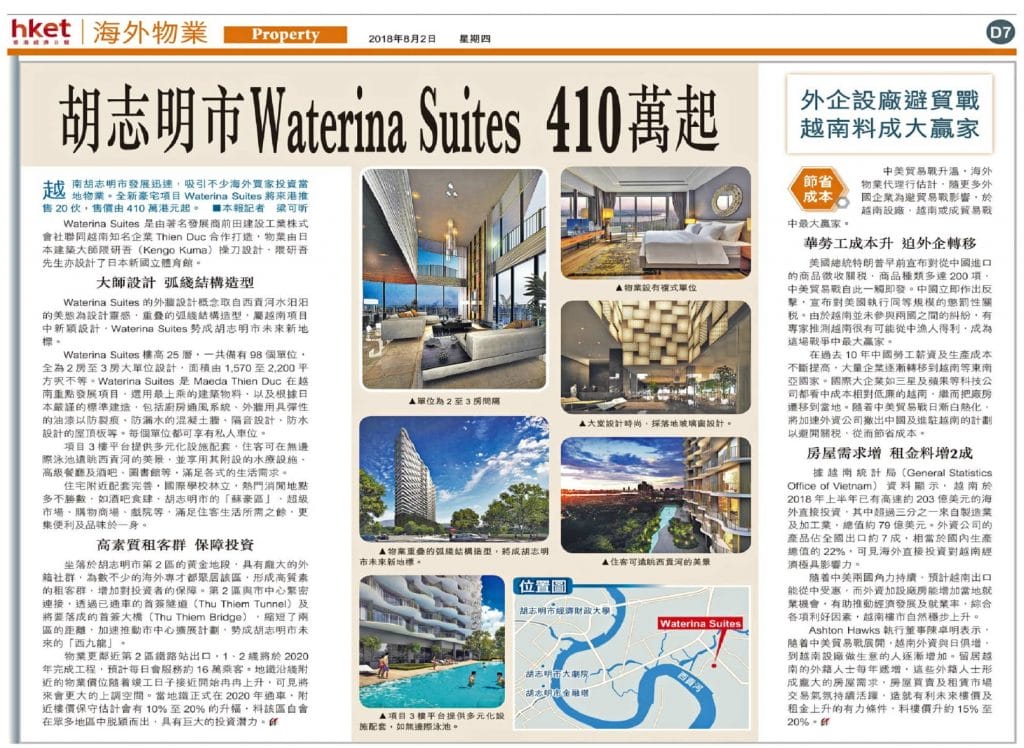

中美貿易戰令很多中國廠商遷往越南發展,為當地注入經濟動力。在疫情控制方面,越南也表現不錯,經濟發展前景令人樂觀,逐漸成為富裕階層關注之地。最近,越南房地產市場帶來首個及全球具規模的品牌住宅項目,由

Masterise Homes發展的萬豪國際品牌住宅Grand Marina, Saigon坐落於胡志明市第1郡西貢河北岸,佔地10公頃,集奢華住宅、寫字樓、商業地產及長達850米海濱長廊於一身,將為胡志明市經濟及社區發展帶來一股新動力。

萬豪國際品牌住宅Grand Marina, Saigon是坐落胡志明市鑽石級地段的全新標誌性項目,由Ashton Hawks引領在香港公開發售。8棟河畔住宅樓宇四周環繞著優美的公園廣場,同時享受到萬豪所提供之優質生活體驗及時尚生活,為越南奢華優質生活重新定義。

配套完善吸引富裕階層

項目除享有無與倫比的河畔環境優勢外,物業與優質學府、餐廳食肆、購物地帶及未來地鐵站均咫尺之隔,文化及商業娛樂匯聚,交通便捷,全面滿足中產及富裕人士對優質生活的喜好需求。

Grand Marina, Saigon為越南首個酒店品牌概念住宅,無論在設施、服務或生活方式質素均經過度身定造,匠心獨運的設計,加上獲著名國際酒店集團支持,令這優質項目能夠匯聚生活品味與富裕人口。

目前,越南中產及富豪人口不斷增加,對優質住宅需求持續高漲,加上區內新供應十分緊絀,在供不應求下,品牌住宅更顯獨特價值。品牌住宅項目的特色除了提供優質生活外,此概念式住宅在市場上增添靈活性及價值。坐落胡志明市最理想地段的Grand Marina, Saigon,既享受西貢河遼闊美景,同時所提供之優質設施服務,符合富裕家庭的生活需求。

據第一太平戴維斯2019年環球研究報告顯示,全球擁有超過420個品牌住宅項目,而萬豪國際集團是品牌住宅市場領域中全球最大參與者,旗下持有100個品牌住宅橫跨25個國家及地區。品牌住宅於環球奢侈品市場具有多項優勢,無論在全球流動性、質量設計、安全品質、所提供之優質卓越服務,以及名牌出品對富豪所帶來之巨大吸引力等,都突顯獨特優勢。

越南地標項目資產價值可傳承

Masterise Homes副總裁兼首席財務官Jason Turnbull說:「Masterise Homes一直以來以打造無可挑剔且具價值的房地產項目而感到自豪。每個項目不單單是純開發之房地產項目,而是能夠一代接一代傳承下去的珍貴物業。可媲美寶石的Grand Marina, Saigon就是在這一宗旨和願景下誕生,為越南首個以萬豪酒店為品牌概念之住宅項目,此坐落於河岸之歷史性地標Bason,將成為越南新地標及全球其中一標誌性項目。」

Ashton Hawks創辦人及首席執行官賴遠方表示:「在強勁經貿發展下,香港人對於越南房地產市場已有一定認識及充滿信心。我們認為,品牌住宅絕對經得起市場挑戰考驗,隨著時間及環境變化仍能保持其真實的價值。很高興將尊貴府邸Grand Marina, Saigon率先引入香港市場,這是一個難得的機遇,項目全然將奢華生活推向極致, 是高淨值人士對優質生活及資產價值的定義。」Grand Marina, Saigon專題講座將於3月27及28日在香港萬豪酒店舉行,屆時全面講解越南豪宅市場增長為品牌住宅帶來之影響力。

Asia Bankers Club founder and chief executive Kingston Lai sees future potential in property markets in Ho Chi Minh City, Hanoi, New York City, Manchester – but he has reservations about London and cities in Australia.

In addition to the investment club targeting bankers and professionals, Lai also controls Ashton Hawks and Golden Emperor Properties, which aim at high net worth individuals and retail investors, respectively, for overseas real estate.

Amid a number of uncertainties, Lai reckons real estate buyers need to think twice. “But the more uncertainty people see from the trade war, the more they are interested in properties in Vietnam, where more manufacturers are expected to move from China.” He says a recent project in HCMC received an overwhelming response.

“Even if the Hong Kong property market were to fall, would flats now valued at HK$10 million plunge to HK$5 million? However, two-room apartments sized between 700 and 1,000 square feet in district 2 and 4 in HCMC cost around HK$2 million and they have the potential to rise further.”

He compares these areas to Sheung Wan, close to the central business district. Apartments further away from the CBD cost around HK$1.2 million only.

Property prices in HCMC have risen on average 15 percent a year over the past three years, compared with as much as 30 percent a year in Bangkok several years ago, says Lai. On average, there is 8 percent gross rental yield in HCMC, he says.

District 1 is the traditional CBD and district 3 is where many embassies and historical buildings are located. Investors have been looking at districts 2 and 4. Last month, the HCMC administration decided that no high-rise apartment projects in districts 1 and 3 will be approved until 2020. Lai expects supply to be even tighter.

He is also bullish on the property market in Hanoi, where Samsung, Apple and Microsoft have invested. The World Bank projected GDP growth in Vietnam to be 6.8 percent in 2018 and 6.5 percent in 2019.

Although Koreans and Japanese are the top foreign investors in Vietnam, Lai says they are not keen on buying properties, unlike Hong Kong and mainland Chinese, who can rent the flats to them. “You can compare HCMC and Hanoi with Shanghai and Beijing, respectively, but we are yet to find a Shenzhen in Vietnam,” Lai says.

Overseas people can buy property in Vietnam and sell or lease it to locals and foreigners. A 50-year leasehold ownership will be given to foreigners with renewal possibility.

When buying a property in Vietnam, investors are subject to 0.5 percent stamp duty. For rental income, they are subject to about 10 percent income tax. If they want to sell the property, 2 percent personal income tax of the selling price will be charged.

Foreigners need to have a bank account in Vietnam and need to sign the sales agreement in person. Mortgages are not available. He says the firm has helped a client to gain about 16 percent to buy and sell a property in Vietnam within a year.

Lai, a Malaysian Chinese, says it takes time to assess the political situation back home. He adds that properties in Singapore are too expensive to buy.

Investors in Thailand property should be cautious. Lai says that a studio in Bangkok near a metro station costs between HK$1 million and HK$2 million, while those costing only HK$500,000 may be in very remote areas that will be difficult to sell or rent out.

As for developed markets, Lai sees potential in New York City.

Sellers have been cutting prices there with less demand due to a tax reform that changes the mortgage interest and property tax deduction, making home ownership less attractive.

While this also applies to foreigners, Lai says some Hong Kong buyers note that the US-HK dollar peg minimizes currency risk. They expect long-term capital gain in New York City center, where there is continuing redevelopment and population growth.

Despite the interest among locals for London homes, Lai is cautious in the wake of Brexit and the high costs of investing there. He sees more potential in Manchester, which he believes could be a future London, Liverpool and Birmingham.

In Australia, Lai says banks will only provide construction financing to developers if they have sold a substantial amount of an uncompleted project. He worries some developers may struggle.

He also sees potential in Japanese real estate but the company does not have expertise there. “We only sell projects that we can manage. We sell about 1,000 units a year. We try our best to ensure customers’ properties are well-managed and can be rented out,” he says. “Selling projects by major developers is one of the ways in which we have peace of mind.”

Ashton Hawks and Golden Emperor Properties serve clients with different needs.

“If you tell me HK$1 million cash is all that you have, I won’t tell you to place it all into a property in Vietnam.

“Instead, we have helped a retired customer to spend HK$500,000 to buy a condo in Thailand for his own use and the rest for his spending.

“Customers like bankers may bet on some properties in Southeast Asia and at the same time invest in London, or New York City, for long-term stable growth.”

Source: The Standard

我們的董事總經理賴遠方先生接受《東周刊》採訪,講述他創業的故事。